IENE Reports & Proposals

3rd South East Europe Energy Dialogue-Conclusions

Posted: Tuesday, March 9, 2010

Although important progress has been achieved in several key areas of the energy sector over the last 12 months a large part of the findings of this year’s SEEED are formulated along the same lines as those of last year. Therefore, certain parts of the conclusions are inevitably similar to those of the 3rd SEEED. The following summarizes the conclusions of the conference per energy sector:

1. Electricity

(a) Once more it became evident that the Electricity Markets are at the forefront of energy developments as they have become the faster moving sector of the broader S.E. European Energy scene. The structure of the electricity sector is changing fast in many countries of the region with the emergence of privately backed initiatives for the construction and operation of new power stations. The availability of natural gas, which allows the operation of easy to construct CCP’s is playing a key role in the development of the sector and the addition of new capacity.

Independent Power Producers (IPP’s) are gradually finding a place in the market and are continuously gaining market share. (e.g. Romania, Bulgaria, Croatia, Greece, Turkey). However, there are still many countries (e.g. Serbia, Montenegro, Bosnia & Herzegovina, Albania, FYROM) where state monopoly in power generation is prevalent. There are positive signs though, indicating that efforts are in place to introduce new players in the market. A latest example, being Montenegro which is moving fast in order to privatize substantial part of its power sector.

(b) In spite of the entrance in the electricity sector of IPP’s, there is still lack of real competition, since in most cases the market is dominated by the incumbent state controlled electricity companies. Therefore there is a need and scope to encourage competition at all levels. The setting up of national or regional electricity exchanges (as is the case with Slovenia) and the operation of daily electricity markets (as is the case in Greece, Bulgaria, Romania, Turkey etc.), are considered necessary steps in the road towards full market liberalization.

(c) The present situation in the electricity sector of SEE can be summarized as follows:

(i) The region is characterized by differing degrees of unbundling in each country but with no single country having achieved full market opening. There is a wide range of free market share. However, the situation has improved considerably over the last two years with the outlook looking positive for a successful unbundling in few countries, notably Greece, Bulgaria, Romania, Serbia, Montenegro and Turkey over the coming years.

(ii) Lack of adequate electricity supply in SEE region (each national power system is hardly covering its electricity demand) with exception of Bulgaria, Romania and Greece remains one of the major problems. S.E. Europe faces a clear lack of capacity as SEE is short on power now and the deficit is likely to deepen as demand growth is expected to recover after recession. S.E. Europe imported a net of 15 TWH in 2007.

(iii) High electricity prices still characterize the SEE region. The range of power prices (wholesale & retail) in SEE is well below the full cost. Notably the power price in some countries does not cover even the variable costs. The full costs of new plants are covered only in few countries like Greece where there is absence of cost-reflective tariff systems (unrealistic low electricity prices for domestic consumers are evident in most SEE countries).

(iv) Potentially there is a vicious circle problem with energy investments. (lack of capacity Regulation

Poor return of investment no investment

increased lack of capacity) The solution is still to be found in full liberalization.

(d) As far as market and regulatory development is concerned, the following are some key observations:

(i) Significant progress has been noted towards reaching full compliance with key Regulation (1228/09) concerning network congestion problems. As a result cross border electricity flows have improved with much larger capacity of the interconnections and transmission systems having become available (No pro-rata allocation of capacity and no long term contracts). Regional wholesale market arrangements need to be developed further with EC Energy Community assisting the process. Regional market design can be developed using the existing mechanisms of the Energy Community Treaty.

(ii) There has been a noted improvement in the transparency regarding the allocation of cross – border capacity over the last 12 months with most contracting parties having introduced a market based capacity allocation scheme (50/50 split).

(iii) In spite of progress achieved so far there is need for more harmonization of the regulatory framework and market rules in SEE.

(iv) There is a need for Harmonized Congestion Management schemes to be developed in the SEE region. There is an urgent need for the establishment of a Coordinated Auction Office.

(v) As more RES power capacity comes on stream in SEE (notably wind farms and PV plants) good regional interconnections will be needed as the national grids, in their majority, are rather small and weak if not isolated.

(vi) It appears that lack of WMO in the SEE region still remains one of the major reasons for lack of investments in the power generation sector.

(vii) Implementation of cost – reflective tariff systems in all countries of SEE region is one of the major prerequisites for the operation of WMO, which will enable gradual transition of electricity prices from social to market values.

(viii) WMO is mainly driven by political influence and national strategies (there is an evident political energy strategy of all national electricity industries in SEE region to keep being “national champions” in order to fulfill national needs for electricity, slow process of electricity sector privatization, etc.). As WMO is affected by PSO’s and national procurements for electricity there is scope for the introduction of special provisions which will obviously differ from country to country.

(e) The liberalization process in SEE is vital for the opening of the market and the realization of substantial new investments in electricity. The following are some of the most important points raised at the Dialogue:

§ There is a need for strong and independent institutions, i.e. regulators, market operators, power exchanges.

§ “The devil is in detail” – while the free market principles may be formally implemented, they would not work unless supported by user friendly and transparent detailed market rules.

§ There is a need to consider all consequences (social, environmental etc.) and on that basis make pragmatic implementation decisions.

§ Small markets need to integrate to create “critical mass” and to dilute market power of local incumbents.

§ Regulatory independence combined with political commitment to full market liberalization remains the key success factor.

§ Although there are notable differences in the electricity market structure between S.E. Europe and the rest of Europe, and therefore it will take sometime for a successful transition to an open market, the path has been laid towards full liberalization in several countries of the region. These countries can act as drivers and pressure centres in the process of overall market transformation. In this context the current “S.E. Europe energy Dialogue” has an important and useful role to play.

2. Natural Gas

New oil and gas pipeline projects, LNG terminals and natural gas storage facilities are in the process of planning or construction and thus a closer cooperation and strong interaction among Balkan countries is now urgent in order to develop a much needed new energy infrastructure in the region. As some elements of this infrastructure are complimentary to each other the need for dialogue, cooperation and joint projects is more than ever apparent.

South Stream (with its two branches, north and south), TAP, IAP, IGI and Nabucco pipelines create an energy ring with important interconnections which affect all the Western Balkans countries, preparing a very fertile ground for natural gas market development and furthermore guarantying the security of gas supply.

On the other hand it is inevitable that natural gas sector will grow faster in the SE European region because:

v The main driver for gas consumption growth is power generation which is emerging as one of the faster developing sectors of the broader S.E. European Energy market.

v The domestic production is not negligible as there are notable quantities of indigenous natural gas in SE Europe (estimated at 1,00 million Nm3/yr).

v The countries of South-East Europe will remain the fastest-growing markets in Europe.

v While each single SEE gas market is relatively small, a regional approach provides a sound basis for development.

However, there are major challenges for the South East European gas industry in view of the current financial crisis which affect plans for new gas pipelines, new gas fired power stations and the development of domestic gas markets because of a decrease in gas demand in the entire region. This financial crisis can easily lead to:

v Financial uncertainty

v Increase of regulatory and political risks that influence the expected profitability and therefore the decision to invest

v Severe decline of total gas consumption due to a significant drop in industrial and power plant output

In spite of this unpleasant economic situation all speakers agreed that the SE European countries will recover earlier and hence grow at a much faster rate than mature markets in other European countries.

On the other hand the last gas supply/transit crisis between Russia and Ukraine, underlined the serious energy security problems most EU states continue to face. This gas disruption demonstrated and revealed that:

v the existing transmission routes are unreliable

v there is a lack of easy to operate and reliable interconnectors

v there is a lack of cohesive and common European energy strategy

v there is big dependence on Russian gas imports

v European underground gas storages level are significantly low

v Domestic production is declining

v Increase of regional and European gas demand is forecasted on a long term basis

The Balkan Gas Corridor as a vital energy route is recognised as the most reliable solution to the European energy security problem because:

v The SE Europe as a gas interconnected region will be of benefit not only for the Balkans but also for the entire European energy security

v There are several alternative routes for the export of gas from Russia, Central Asian Countries and Iran to Europe via SE Europe

v The prospect of new gas corridors across the region should encourage the development not only of internal gas infrastructure development but interconnection projects as well

v There is an urgent need to strengthen security of supply (i.e. balanced diversification of supplies supported by indigenous production - creating underground storage capacities to serve domestic and international markets)

A key finding of the 3rd SEEED was the urgent need to develop reliable gas interconnector project across the whole SEE region. The current Greek – Bulgarian gas interconnector project serves as a good example. The project was unveiled after the Rusian – Ukrainian crisis following the catastrophic impact of gas disruptions in Bulgaria. The Interconnector refers to the construction of a bi-directional natural gas pipeline from Greece’s Komotini to the Bulgarian city of Dimitrovgrad. The pipeline will connect the two National Natural Gas Systems and it will guarantee an uninterruptible gas flow. The total length of the pipeline will be app. 110 km, of which 20 km will be in the Greek territory. The project has already secured for 45 million Euros finance through the European Energy Recovery Programme.

3. Hydrocarbons

Both upstream and downstream issues were examined in the relevant session of the Dialogue with emphasis placed on oil and gas exploration.

The current global economic recession and the swift drop in crude oil prices (i.e. almost half in relation to 2008) and the forecasted supply drop which will inevitably follow, is now leading to an oil price rebound, with the US dollar slipping while global recovery has slowly started. One of the main conclusions of the panel was that anticipated higher oil prices (above $80 p.b.), and forecasted increase of energy demand, combined with shortages of existing resources, create new big challenges in the SE European region for investment opportunities both in the upstream and downstream sectors. Strong cooperation and synergies between, the governments and stakeholders are necessary in order to reduce the investment risks and increase the security of energy supply.

The Bourgas – Alexandroupolis project, the first major oil pipeline to S.E. Europe to be built in the region for a long period, is almost ready to enter the construction phase. Through the implementation of this project Bulgaria and Greece aim to become oil transit countries and this is encouraging for the planning of further oil pipelines in the region.

The upstream sector in oil and gas in S.E. Europe continues to present significant opportunities for investment. There are important initiatives under way offshore in the Black Sea area (Bulgaria, Romania and Turkey), where through PSA’s several exploration progammes are currently in progress.

In the Western Balkans, Albania is intensifying its efforts to upgrade existing production facilities. Albania has a good potential capacity in oil fields since their recovery coefficients are very low due to the lack of modern extraction technologies and limited investments for production in the oil sector.

At the same time, new exploration areas have been identified and the government will soon announce terms and conditions for the participation of international companies for undertaking new oil exploration and production activities. Promising oil and gas deposits that need to be explored, lie further north, mainly in offshore areas in Montenegro and Croatia.

A precise and attractive legal and licensing framework in Bulgaria has proved instrumental in attracting considerable interest and investment in hydrocarbon exploration activities both onshore and offshore. Some positive results in terms of proven hydrocarbon reserves are expected to be announced soon thus increasing the region’s hydrocarbon potential.

Given the current high oil prices, Greece whose terrain appears more difficult, could become a new destination exploration area. Greece remains one of the least unexplored areas of the Mediterranean and therefore there are considerable investment opportunities. However, the government has yet to be convinced to open the E& P Market. Although there exists an up to date legal framework for hydrocarbon, E & P Greece does not yet have a competent independent authority or department within the Ministry of Development, which can undertake to organize the necessary international oil rounds.

Therefore, the latest undertaking by Aegean Energy to invest in Kavala Oil, the Prinos field operator (Greece’s only oil production well) signifies an important turning point in the country’s hydrocarbon exploration sector. It must be noted though that Aegean was able to obtain the necessary exploration permit since the Prinos area through Kavala Oil has already been licensed for operation and production since the mid ‘90’s. The Prinos field has been in operation since 1977 and total oil production up to now has exceeded 110 million barrels.

Already production at Prinos has increased threefold (more than 3,000 bd) with much higher production foreseen once the Epsilon field comes on stream (more than 7,000 bd is anticipated). The revitalization of the Prinos oil and gas fields, and the substantial investment already committed, is indicative of Greece’s anticipated high oil and gas potential not only in the Thassos – Prinos area but also in many other parts of the country.

Kavala Oil produces hydrocarbons through a system of three offshore oil platforms, one gas platform and a comprehensive onshore plant with storage, offshore loading, desulphurization and power generation facilities. The entire production is sold through an offtake contract to Hellenic Petroleum S.A.

Concession rights are in place to develop two new offshore fields (Prinos North and Epsilon) located in the Gulf of Kavala. New drilling operations at Prinos North commenced in March 2009 and continue today at the Epsilon field.

Another little explored area of the region, in terms of hydrocarbon potential is Cyprus, which two years ago commenced an ambitious offshore exploration programme. Backed by thorough geological and geophysical assessments, including extensive seismic surveys, and following the delimitation of its territorial matters and its Economic Exclusive Zones (EEZ) was able to conduct a first international oil round which attracted considerable international interest. The trust official Offshore Licensing Round closed on August 17, 2007 with the subsequent granting on October 2008 of a Hydrocarbon Exploration license to UK’s Noble Energy for an initial period of three years. A second Licensing Round is envisaged for early 2010. According to independent sources Cyprus hydrocarbon offshore potential exceeds 4,0 billion barrels of oil equivalent.

The overall conclusions from the presentations made in this session and the discussion which ensued as part of the Dialogue are as follows:

(1) There is considerable offshore and onshore hydrocarbon potential in several countries of the region.

(2) The relatively high oil prices have motivated governments and companies to pursue new or to continue with existing exploration activities.

(3) New oil and gas production is envisaged in the near future as a result of the above activities thus strengthening SE Europe’s energy resource base.

(4) The region offers excellent opportunities for the overland transportation of crude oil and products through new oil pipelines. The Burgas – Alexandroupolis pipeline, construction of which is due to start in 2010, is a good example.

4. Renewables and Climate Change

The European strategy for the energy and the environment comprises ambitious targets for 2020 with 20% RES penetration in gross final energy consumption together with energy savings and increased energy efficiency to reduce greenhouse gas emissions and comply with the Kyoto Protocol. Those factors also have an important part to play in promoting the security of energy supply, promoting technological development and innovation and providing opportunities for employment and regional development.

The new Directive 2009/28/EC (OJ L140 issued on 05.06.2009) of the European Parliament and of the Council of 23 April 2009 establishes a common framework for the promotion of energy from renewable sources and sets mandatory national targets for the overall share of RES in gross final energy consumption in 2020. The national overall targets for the EU member-states are: Bulgaria 16% from 9.4% in 2005, Greece 18% from 6.9%, Romania 24% from 17.8%, Cyprus 13% from 2.9%. Moreover, aggressive national targets in RES electricity are expected so that 1/3 of power generation in the EU would be produced by RES in 2020. This is very important for the countries in the region of SE Europe with high potential of RES because joint projects between member-states and between member-states and third countries are provided and reinforcement of the interconnection HV lines is expected.

The high potential of renewable sources in Turkey, such as solar, wind, hydro, biomass, was pointed out. New feed-in tariff for photovoltaic power generation was launched recently and a number of wind parks in the north-west part of the country a high wind potential area, have been developed. A national energy efficiency plan with targets is running in Romania and a strategy for RES penetration into the country energy balance has been elaborated. Financial schemes to support the RES applications are mentioned and the idea of green certificates to support RES-electricity was adopted. Hydropower is the most important renewable energy source in Romania and the high potential of biomass was pointed out. Some wind parks have been installed in the country and a pilot program for space heating in 10 schools by geothermal and heat pumps is promoted.

An efficient regulatory framework for RES-electricity based on feed-in tariff mechanism has been elaborated in Bulgaria. Well-designed tariffs for each renewable energy source are attractive for local and foreign investors. A number of projects in photovoltaic, wind, hydro and biomass are in development in Bulgaria, while some others (>5MW) are in the licensing process.

Clean technologies for power generation by solid fuels (coal and lignite) and the European experience were presented. The evolution of supercritical steam technology results into the efficiency increase as well as to power plants’ capacity increase. The available options on carbon capture and storage technologies (CCS) and the proposed pilot projects of zero emission fossil fuel power plants (ZEP) in Europe with short-term schedule for implementation have been discussed. The commitment for Green House Gas reduction as well as the purchase of CO2 allowances is expected to surcharge the electricity generation cost, without reference to the implementation of Carbon Capture and Storage. The CO2 capture cost for solid fuel units is competitive in comparison to natural gas solutions for electricity production.

The geothermal potential in South East Europe and relevant applications and direct heat uses were presented. The significant potential of low enthalpy geothermal sources for exploitation in the region is pointed out.

Challenges for sustainable energy supply leads to the integrated energy systems. Optimization of the energy mix, efficiency enhancement along the entire energy conversion chain and smart grid/systemic optimization with most advanced technology for intelligent grid management are considered the three steps to a sustainable energy supply.

Efficient regulatory framework for RES and supporting tools in order to reduce the greenhouse gas emissions, sharing the same vision in the region, should be introduced in order to meet the targets of the new Directive for RES.

Optimization with most advanced technology for intelligent grid mad t

5. Investments and Markets

It is difficult to arrive at some general conclusions regarding investment prospects and requirements for the region given the great disparity in terms of energy infrastructure and the widely ranging degrees of

economic development of the countries in the SEE region. However, some general observations can be made on the basis of the presentations made in the various sessions.

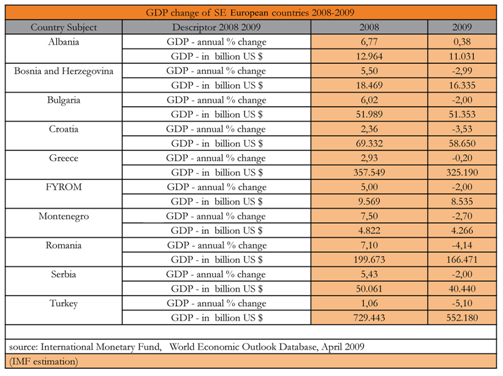

(i) Compared to the Eurozone and until recently (i.e. end of 2008) the economies of SEE region were developing at a really fast pace, with GDP growth raging from the low of Greece’s 3.5% to Romania’s 6.1%, Albania’s 6.2% and Turkey’s 6.8%. The last quarter of 2008 and all this year the growth rate of the various economies of the region have been seriously affected (see attached table). Despite the present economic downturn the long term investment outlook in the region’s energy sector remains positive although there is going to be a temporary slow down on investment plans. However, no significant project cancellation has yet been announced.

(ii) A slag in energy demand growth is anticipated in most countries as a result of the present economic climate. This is very much in evidence in the case of electricity, oil and natural gas consumption.

(iii) Although there is strong investment drive with high proportion of FDI’s in most countries, as a result of market reforms over the last 15 years (with high investment / GDP ratios, i.e. Bulgaria 31%, Romania 31.2%, Turkey 25.3%) investment in the energy sector generally lacks behind.

(iv) Since the formation of the “Energy Community” there has been renewed interest for investment in the region’s energy sector. Much needed reforms in energy market operations, aimed toward greater competition, are bound to attract greater investments, especially from the private sector.

(v) In addition to building new electricity and natural gas infrastructure, there is great scope for upgrading the region’s refining capacity. There are also promising opportunities in oil and gas exploration in almost all countries of the region

(vi) The need to diversify energy imports and supplies, the creation of competitive markets and the improvement of energy efficiency, present serious investment opportunities in almost all SEE countries.

(vii) As there is an urgent need for an increase in power generation capacity in all countries of SEE, investment in this sector has a clear priority, especially as there appear to be very satisfactory IRR’s.

(viii) Several cross-country oil and gas pipelines are in the planning or construction phase and when completed are expected to generate extra income from both local sales but also from transit fees.

(ix) International donors and global finance institutions (e.g. World Bank, EBRD, EIB, US Aid) are playing an important and active role in implementing energy projects and in attracting investor interest and funding by providing an independent and transparent investment framework.

(x) There is considerable scope in the energy sector of SE Europe and according to conservative estimates a total of €60.0 billion is earmarked for infrastructure projects in the energy sector from now until 2015.